By: Kari Hamanaka | Link to article

The shipping container revolutionized the shipping industry. Maybe next is the concept of open sourcing the supply chain.

That’s the idea driving American Eagle Outfitters chief supply chain officer Shekar Natarajan as he looks to expand the concept of sharing across retail when it comes to the resources used to move product.

“We’re trying to create a new age of supply chain technology and supply chain operations, which I think is going to level the playing field,” Natarajan said Monday at the NRF Supply Chain 360 conference in Cleveland.

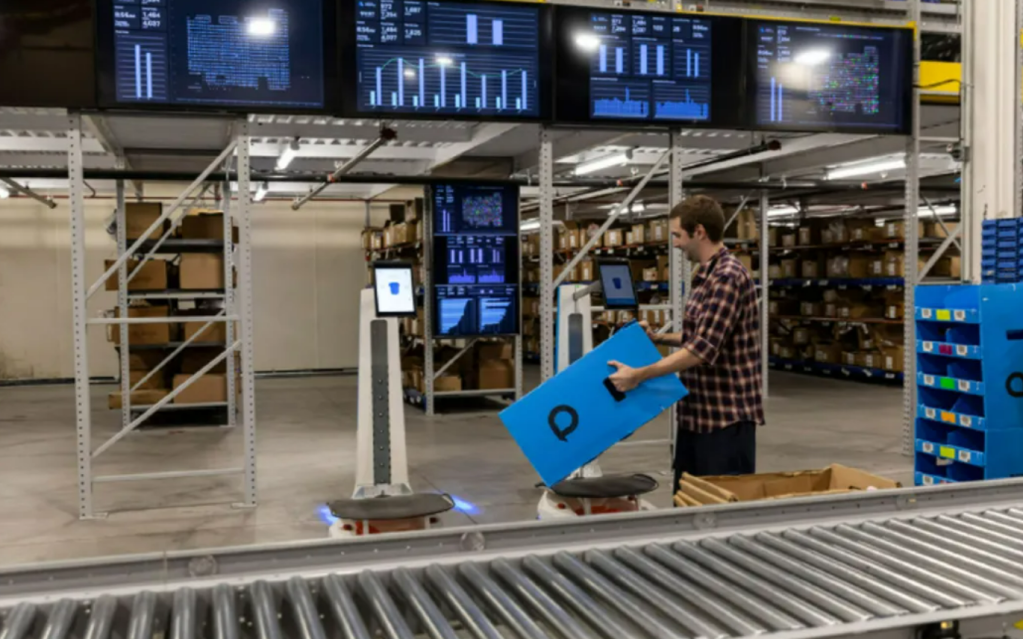

It helps American Eagle is building up its logistics capabilities, with its acquisitions last year of logistics provider Quiet Platforms and parcel delivery company AirTerra. In May the company said it struck a partnership with Pitney Bowes to further boost its delivery capabilities as logistics becomes a promising business for American Eagle, with the retailer’s executive chair and CEO Jay Schottenstein calling Quiet a “growth vehicle” during the company’s quarterly earnings call last month.

Quiet helped reduce American Eagle’s number of shipments per order and also slashed delivery times for online orders by 13 percent during the company’s fiscal first quarter ended April 30.

Natarajan showed off a modular, collapsible shipping box system that the company is developing with the idea it could be used to ship items from multiple brands to a customer’s doorstep.

“I see that the world is going to be even more constrained with supply chain assets and so price escalation is going to happen,” Natarajan said. “And so to counter all of that, we need to have consolidation networks.”

That’s what American Eagle is now trying to do with Quiet, he added.

The box Natarajan showed is a first-generation prototype. A second-generation model is set to come out in July, with the goal to begin piloting it at one of Quiet’s facilities by the end of the year with brands that want to participate.

Quiet currently works with 70 brands, ranging in size. Saks Off Fifth and Fanatics are some of the more recent additions.

The pitch to other brands is that by consolidating those supply chain resources, enough scale can be achieved to compete with the likes of Walmart, for example.

Natarajan pointed out that American Eagle moves 225 million units a year. Walmart, by comparison, moves some 50 billion units. To try and compete from a logistics standpoint with Walmart would require multiple companies pooling their businesses together.

“So, in a place where you’re competing on expenses, in a place where you’re competing on products, the last thing you want to do is compete on supply chains,” Natarajan said. “Because competing on supply chains is really competing on resources, labor, utility, land, Mother Nature and we’re only going to make it worse.”

All that said, Quiet is seeing success in other companies wanting to join its platform, according to Natarajan.

“This is very similar to how we think about [the] internet. [The] internet was actually built on open protocols,” he said.

The current run up in fuel prices is also incentivizing more retailers to take up the concept of shared supply chain services with Quiet, he added.

“I don’t think any logistics company and the CEO of that company will ever go back to their boards and say, ‘Let me make less money next year than this year.’ That’s not going to happen. We all would love to think that the world of containers is going to drop back to $1,500…for every container. That’s not going to happen either,” he said. “So, I think the prices are here to stay. Inflation is here to stay with us, and so the best thing to do is look for expense reduction models. So this is a structural change. This is how you distribute the inventory. This is how you ship a package with others shipping to the same destination.”

The challenge to solve as more companies join Quiet’s roster is how to connect different systems since each retailer has its own legacy processes.

The first solution the company’s working on is that shipping box prototype.

“All these are going to take time to do,” Natarajan said, “but I see a world where there’s no alternative. There’s going to be very big companies, and the small companies will not have a level playing field unless and until they start really competing on what makes them unique, which is brands and products.”